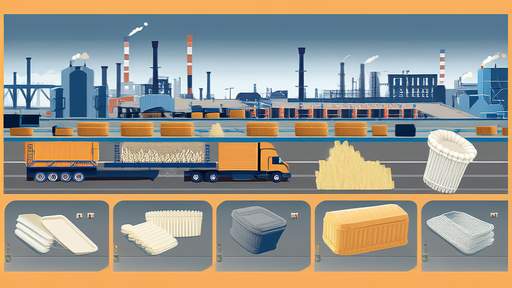

The global shift toward sustainable materials has brought biodegradable alternatives into sharp focus across industries. Yet the transition from conventional plastics to bio-based solutions isn't happening as swiftly as environmentalists had hoped. Behind this delay lies a complex economic phenomenon: the commercial substitution tipping point—the moment when biodegradable materials become cost-competitive with traditional polymers without sacrificing performance. This invisible threshold is reshaping supply chains, influencing corporate strategies, and determining whether eco-friendly packaging will remain a niche product or achieve mainstream adoption.

Market forces have kept petroleum-based plastics dominant for decades. Their production costs hover around $1 per kilogram, while even the most advanced polylactic acid (PLA) or polyhydroxyalkanoate (PHA) bioplastics typically cost 2-3 times more. But this gap isn't static. Fluctuating oil prices, carbon taxation policies, and manufacturing innovations are altering the equation. In 2023, a European Commission report revealed that certain compostable food packaging formulations reached price parity with polystyrene in markets with strict extended producer responsibility laws. This wasn't universal—geography and application specificity still mattered tremendously—but it signaled that the tipping point wasn't hypothetical.

The infrastructure paradox complicates this transition. Even when biodegradable materials achieve cost competitiveness, their environmental benefits only materialize with proper composting facilities. Most municipalities lack industrial-scale composting, leading to scenarios where "biodegradable" products end up in landfills, degrading no faster than conventional plastics. This mismatch creates a chicken-and-egg dilemma: manufacturers hesitate to fully commit without infrastructure, while waste management companies resist investing in infrastructure without sufficient material volume. Pilot projects in cities like San Francisco and Milan demonstrate that coordinated policy interventions can break this cycle, but such successes remain exceptions rather than the rule.

Consumer psychology plays an underappreciated role in reaching the substitution threshold. Surveys consistently show willingness to pay premiums for sustainable packaging, but real-world purchasing data tells a different story. When faced with identical products—one in biodegradable wrapping at a 15% markup—the majority still choose cheaper conventional options. This behavior persists until price differentials shrink to 5% or less, according to a 2024 meta-analysis by the Cambridge Institute for Sustainability Leadership. The lesson for manufacturers is clear: marginal cost reductions matter more than ecological messaging when crossing the commercial viability threshold.

Technological advancements are quietly accelerating the timeline. Next-generation enzymatic depolymerization methods now allow certain bioplastics to be recycled alongside traditional polymers—a game-changer for adoption in rigid packaging applications. Meanwhile, companies like Full Cycle Bioplastics are commercializing processes that convert agricultural waste into PHA at scales previously deemed unprofitable. Perhaps most crucially, material scientists have nearly closed the performance gap for moisture barrier properties, historically a weakness of bio-based films. These innovations collectively lower the substitution barrier by addressing both economic and functional limitations simultaneously.

Regulatory pressures are becoming the wild card that could abruptly shift the calculus. The European Union's Single-Use Plastics Directive already prohibits certain conventional plastic items, creating instant markets for alternatives. Similar legislation is advancing in Canada, Australia, and twelve U.S. states. What makes these policies particularly impactful is their focus on performance standards rather than material prescriptions. By mandating specific compostability timelines or marine degradation rates without specifying chemistry, they spur innovation across multiple biodegradable material platforms simultaneously. This regulatory approach avoids picking winners and instead lets market forces identify the most viable solutions.

The agricultural dimension introduces both opportunities and complications. Most biodegradable polymers rely on corn, sugarcane, or other crops as feedstocks, linking their production costs to volatile commodity markets. During the 2022 global wheat shortage, bioplastic producers faced input cost spikes just as oil prices declined—a perfect storm that set back substitution timelines by 18-24 months in some sectors. Vertical integration strategies, where material companies control their own feedstock supply chains, are emerging as a hedge against such fluctuations. NatureWorks' acquisition of a Nebraska-based corn ethanol facility exemplifies this trend toward securing price-stable biomass sources.

Looking ahead, analysts predict the substitution tipping point will arrive unevenly across market segments. Flexible packaging for organic produce and disposable cutlery may reach viability by 2026, while durable goods applications could take until 2032. The determining factors—oil price trajectories, policy developments, and recycling infrastructure investments—interact in ways that defy linear projection. What's certain is that biodegradable materials are no longer a fringe concept but an inevitability awaiting the precise alignment of economic and technical stars. When that alignment occurs, the shift could happen with surprising speed, rewriting material supply chains almost overnight.

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025

By /Jun 3, 2025